#FrontRunners is a series of spotlights on prominent members of the Luge Capital network. We are fortunate to have access to this network and wish to share with FinTech entrepreneurs their industry insights and tips on partnering with their organizations.

Over the course of my career, advising start-up founders, one of the common growth strategies I see is the establishment of partnerships to build scale in insert function name here — sales, go-to-market, implementation services, brand awareness, etc. or even all of the above.

It makes a lot of sense! You have limited resources and can’t do everything.

At the same time there are others out there who can not only fill those gaps but who can also significantly accelerate your growth and time to achieve scale. The common refrain is if we can put the capabilities of the two teams together 1+1 can equal 3. In cases where the partner is a much bigger player the belief is that if the partnership is really successful this could become a potential exit path.

It’s a good strategy, at least on paper. The reality, however, is often quite different based on what I have experienced personally and heard from the experience of other founders. The desired 1+1 =3 often doesn’t even equal 2, as the expected benefits from the partnership are rarely met. This is because partnerships are really easy to create (sign an NDA and a short contract in most cases) but they are very difficult to successfully operationalize.

I’m going to share the top 5 things I’ve seen in my experience that companies need to build into their partnership structures in order to have a chance of success.

1. Be clear on what’s in it for each party.

This should be obvious but in most partnerships the outcomes and expectations are loosely defined and not well understood by each party. In order for a partnership to be effective there has to be a clear meeting of the minds from the outset. This should be set out in a Partnership Charter or a similar document where:

-

- Each of the partners articulate what success means to them.

- The expected timelines or milestones for achieving that success, at least in the first year.

- Further, the commitments should be concrete, quantifiable, achievable and also material to each party.

This is important because what is material for one party may not be material for the other. For example, $2 million in net new revenue may be a lot for a start-up but may be meaningless to a partner that currently has $200 million in revenue. If there is misalignment on this point, the expected commitment to the partnership may not be there.

2. Ensure both parties have material skin in the game.

When setting up the partnership, each party needs to invest in making it successful to achieve the outlined objectives. Similar to the previous point, those investments should be “material” for each party.

It is a natural tendency to think of investment as financial but it doesn’t have to be, as long as it demonstrates commitment to the partnership. In fact, financial commitments are often the easiest to make for some large firms. Some examples of non-financial “skin in the game” that I’ve seen which support a successful partnership include: setting up an incentivized sales channel, establishing non-competes, volume commitments, pricing concessions, prioritized placement (relative to other products or partners) and go-to-market commitments.

There are some common red flags that come up, especially when there is a size disparity between the two parties.

As an example, a non-compete can be valuable if the commitment is made on both sides, it’s time-boxed and contingent on achieving milestones. You should, however, avoid non-competes that are one-way streets where the bigger party wants the commitment but isn’t willing to provide the same, or tie it to achievement of milestones.

A second example of a common disconnect is around how to set up an incentivized sales channel. Doing this properly from both sides means having the know-how and capacity to train and enable a sales force, at scale, who can be confident and competent in taking a product to market. It also means setting up appropriate compensation mechanisms to motivate the sale (i.e. the same commission level as other company products and supporting quota attainment). If both sides aren’t in sync, then the sales expectations will likely fail.

3. Clearly define roles, responsibilities and decision rights.

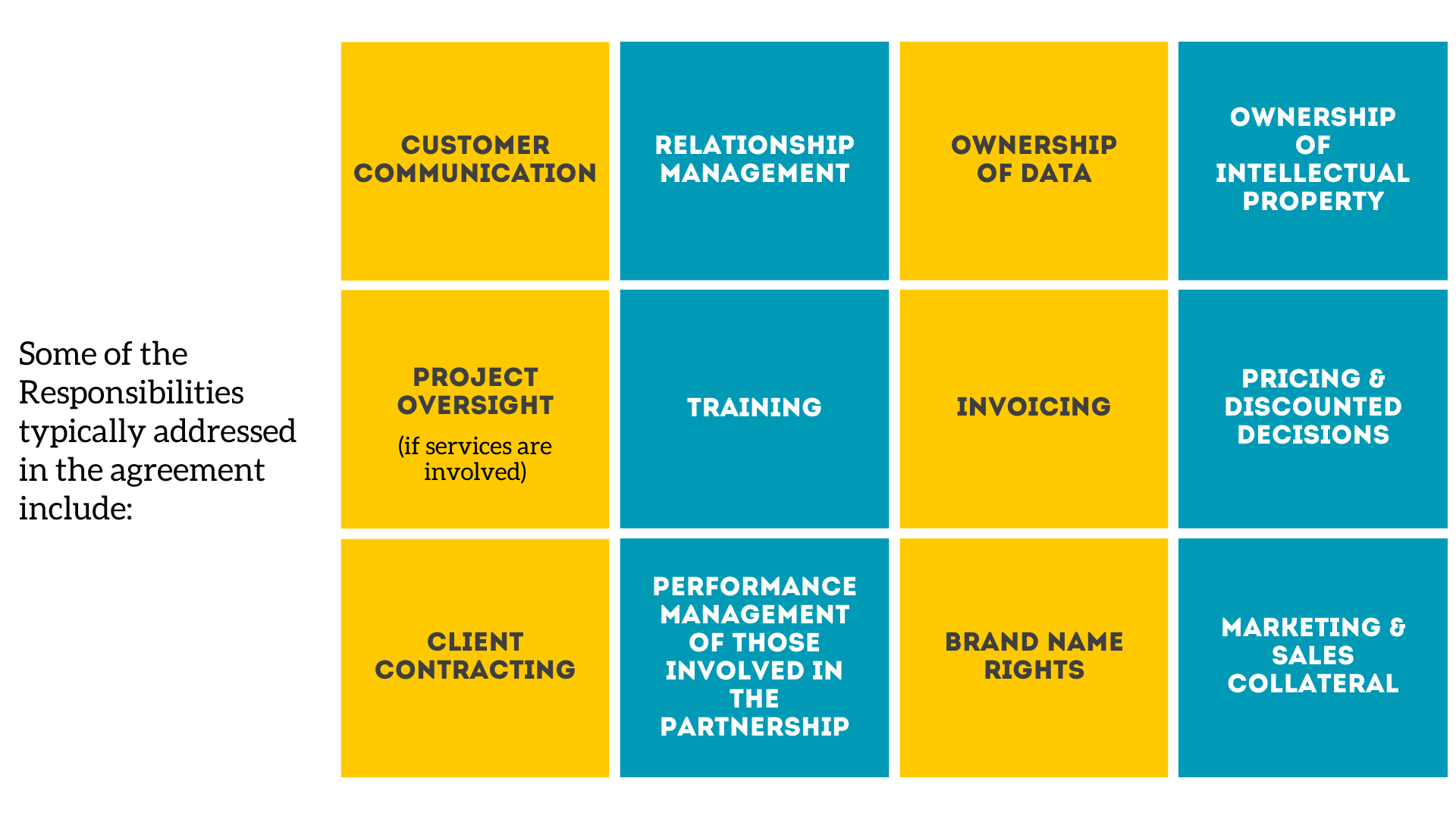

Each party in the partnership should know what they are accountable for, including who has decision rights on key issues. These responsibilities often find their way in the partnership agreement so getting it right is important. Some of the items typically addressed include: customer communication, relationship management, ownership of data, ownership of intellectual property, project oversight (if services are involved), training, invoicing, pricing and discounting decisions, client contracting, performance management of those involved in the partnership, brand name rights, marketing and sales collateral.

Scared yet? This list isn’t exhaustive but these are all elements that usually have to get worked out as part of a robust partnership.

Some ambiguity is fine and expected, since not every situation can be accounted for before they happen. But a baseline understanding of who does what is necessary.

4. Conduct regular reviews on the progress of the partnership.

As you can see, setting up a partnership for success is not an easy task and it’s unlikely to be done right the first time. It’s almost impossible to understand all the things that are going to happen when planning collides with the reality of execution. To that end, it is important to conduct regular business reviews that cover a broad agenda including:

-

- Whether the partnership is meeting the original objectives and milestones

- What is working and what is not working for each party, and what adjustments need to be made

- Success metrics and milestones

- Roles and responsibilities

- Deal economics

These meetings should be held at least quarterly, with the most senior people involved in the partnership attending so that any changes can be addressed by the people who can make decisions. It goes without saying that these discussions should be open and candid to make them effective.

5. Know when to move on.

Once you’re in a partnership, it’s really easy to just stay with it, even when it isn’t delivering on expectations or has run its course. However, it’s important to acknowledge that partnerships usually aren’t for life. They are a means to an end for both parties.

Usually the reasons for exiting a partnership fall into two main categories:

-

- The partner is not delivering on the expected results. In this situation, it is actually a pretty simple decision, if the partner isn’t meeting your expectations, it’s time to find one who will.

-

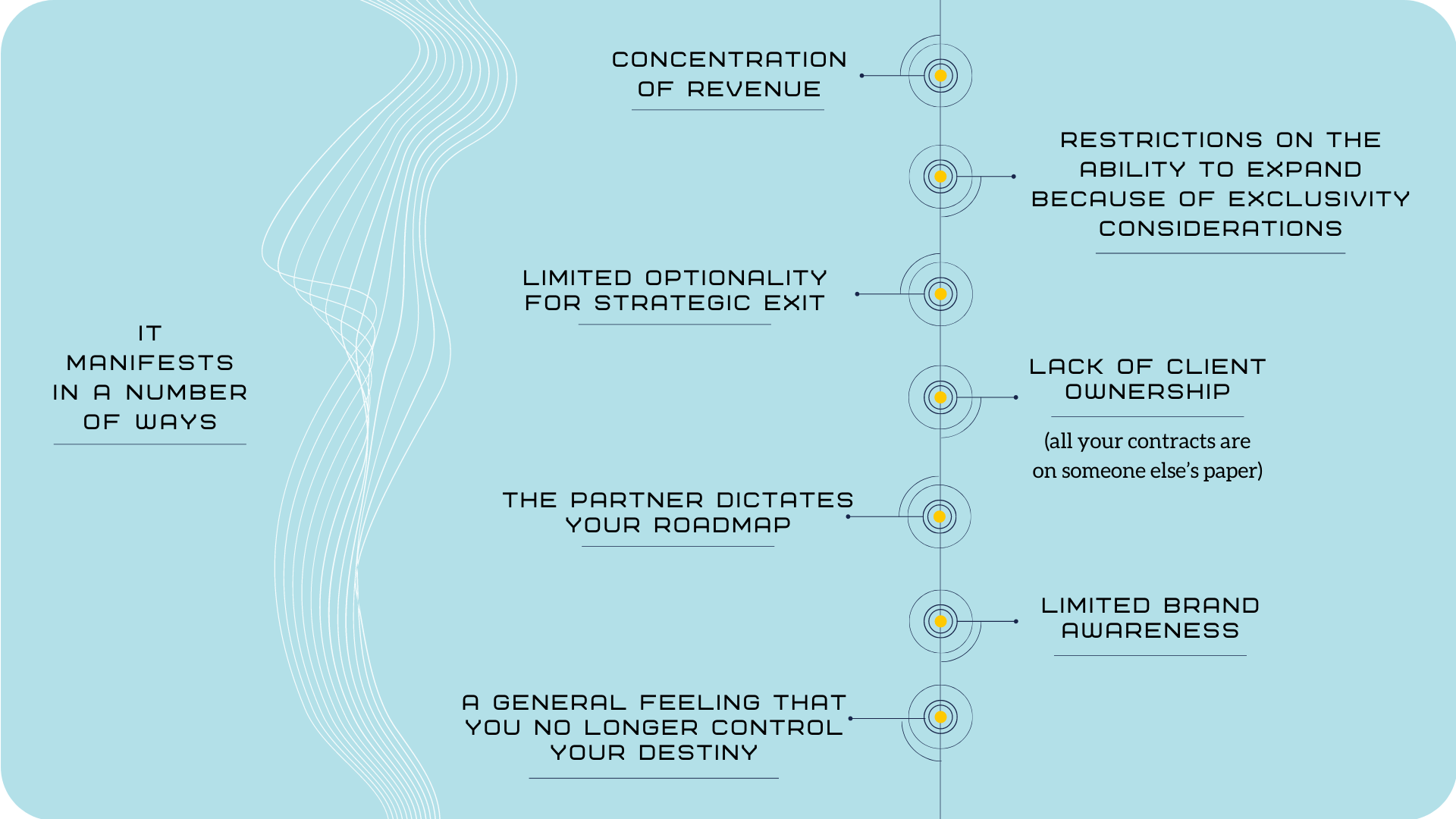

- You are becoming too dependent on the partner. It is far more complex and harder to determine when the risk of staying is higher than the risk of leaving. It manifests in a number of ways: concentration of revenue, restrictions on the ability to expand because of exclusivity considerations, limited optionality for strategic exit, lack of client ownership (all your contracts are on someone else’s paper), the partner dictates your roadmap, limited brand awareness and finally a general feeling that you no longer control your destiny. Recognizing when this is happening is important and thinking about what the end game looks like in advance can save a lot of headaches down the road.

Building real partnerships that generate meaningful results require careful selection of who you work with, and take ongoing focus and effort from your leadership team. If done properly, they can drive significant value for a start-up company looking to accelerate growth, but doing it right isn’t something that happens by magic. It requires material commitment on both sides, a disciplined approach to identifying and driving outcomes, periodic evaluation and re-evaluation, and the maturity to know when to move on.

Good luck!

_____

Avi Pollock is a seasoned leader and entrepreneur who is passionate about helping technology driven companies big and small innovate, grow and transform their businesses. His 25+ year career has been split evenly between leading, scaling and advising entrepreneurial growth oriented companies and in executive innovation, strategy and P&L roles at large companies like RBC and Davis & Henderson (D&H). In 2018 Avi launched his own consulting firm to help start-up and scale-up companies through the key phases of their life cycles with an eye toward building successful, sustainable businesses. He joined Grapevine6, one of his clients in 2019 as President to help grow and scale the company. After experiencing 10x growth, in 2020, Grapevine6 exited to Seismic the leader in Sales Enablement where Avi is now the VP, Customer Success.

Avi is a frequent speaker on innovation and has been active in charitable and community causes, including: Public Service Advisory Board for Canada’s Networks of Centres of Excellence, Camp Ramah in Canada and is the current Chair of the Board at JVS Toronto.

Avi is a graduate of the LLB/ MBA program at York University.

See you soon for our next spotlight & you can follow Luge Capital on Twitter, LinkedIn, or by signing up for our newsletter to get updates and the latest news about the industry and Luge.